nh property tax rates by town 2019

What are you looking for. NH Property Tax Rates by Town 2019.

2022 Property Taxes By State Report Propertyshark

The bills are printed and will be mailed to the property owner of record and are due on December 9th 2019.

. Ad Find The New Hampshire Property Tax Records You Need In Minutes. Search Valuable Data On A Property. Revaluation of Property and the Tax Rate Setting Process.

Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098. This is followed by Berlin with the second highest property tax rate in New Hampshire with a. Ad Find The New Hampshire Property Tax Records You Need In Minutes.

Find New Hampshire Property Records Online Today. 2019 2018 2017 2016. Start Your Homeowner Search Today.

2022 Application for State Election Absentee Ballot. 2016 NH Tax Rates 2017 NH Tax Rates 2018 NH Tax Rates 2019 NH Tax Rates 2020 NH. 2019 Tax RateMunicipal Tax 359Local Education Tax 1235State Education Tax 196County Tax 091Total 1881The Towns Equalization ratio for Tax Year 2018 was 996 as.

Property Tax Year is April 1 to March 31. Your average tax rate is 1198 and your marginal tax rate is 22. Evaluate towns by county and compare datasets including Valuation Municipal County Rate State and Local Education tax dollar amounts.

Hanover Town Hall PO Box 483 Hanover NH 03755 603 643-0742. Find New Hampshire Property Records Online Today. The Town ClerkTax Collector has the responsibility of collecting property yield gravel and timber current use change taxes and sewer payments.

Gail Stout 603 673-6041 ext. Tax Rates General Information. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

100 rows 2019 NH Property Tax Rates Map 15 15 to 25 25 For more tax information about each area click or tap its marker. Property tax bills are due semi. New Hampshire Town Property Taxes and.

New Hampshire Property Tax Rates 15 15 to 25 25 to 30 30 Tap or click markers on the map below for town tax rate information. City of Dover Property Tax Calendar - Tax Year April 1 through March 31. Tax Rates are given in.

Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. Tax Collector Business Hours Monday. Tax Rate History.

Ad Get In-Depth Property Tax Data In Minutes. Our tax calculators offer insights into Federal income taxes margin tax rates payroll taxes estate. Property Tax Year is April 1 to March 31.

Discover public property records and information on land house and tax online. Understanding New Hampshire Property Taxes. The NH DRA has set and certified the 2019 Tax Rate at 2638.

NH Property Tax Rates by Town 2018 Amherst 756994 Andover 637732 City or Town Tax on a 278000 house see note Alstead. City of Dover New Hampshire. Such As Deeds Liens Property Tax More.

Nh property tax rates by town 2019 Wednesday. Ad Online access to property records of all states in the US. Counties in New Hampshire collect an average of 186 of a propertys.

2022 Massachusetts Property Tax Rates Ma Town Property Taxes

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Tax Collector S Office Town Of Strafford Nh

Property Taxes Urban Institute

Does Nh Have A View Tax Citizens Count

Sales Taxes In The United States Wikipedia

Does New Hampshire Love The Property Tax Nh Business Review

About Property Tax Rates In Nh Vt Housing Solutions Real Estate

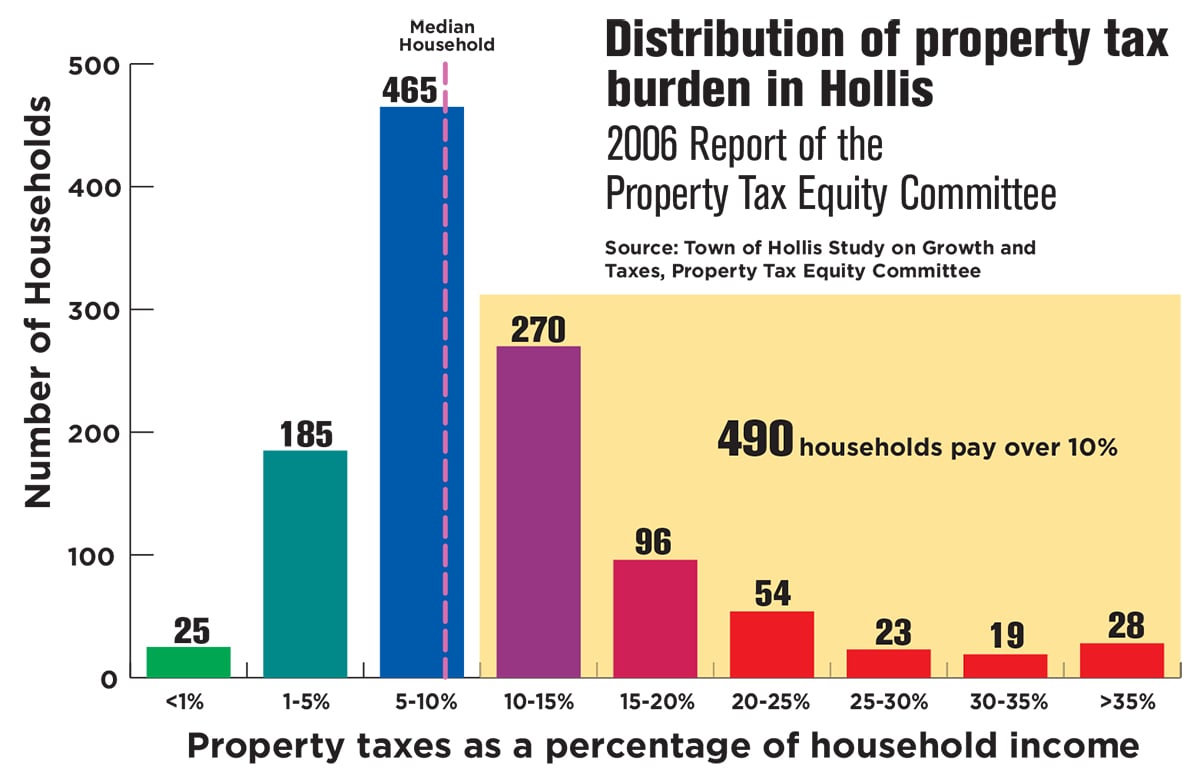

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

Town Clerk Tax Collector Office Town Of New London Nh

Town Clerk Tax Collector Town Of Marlborough Nh

Understanding New Hampshire Taxes Free State Project

Towns Set 2019 Property Tax Rates Monadnock Ledger Transcript

Road And Bridge Postings Status Reports

Mark Fernald Why Your Property Taxes Are So High